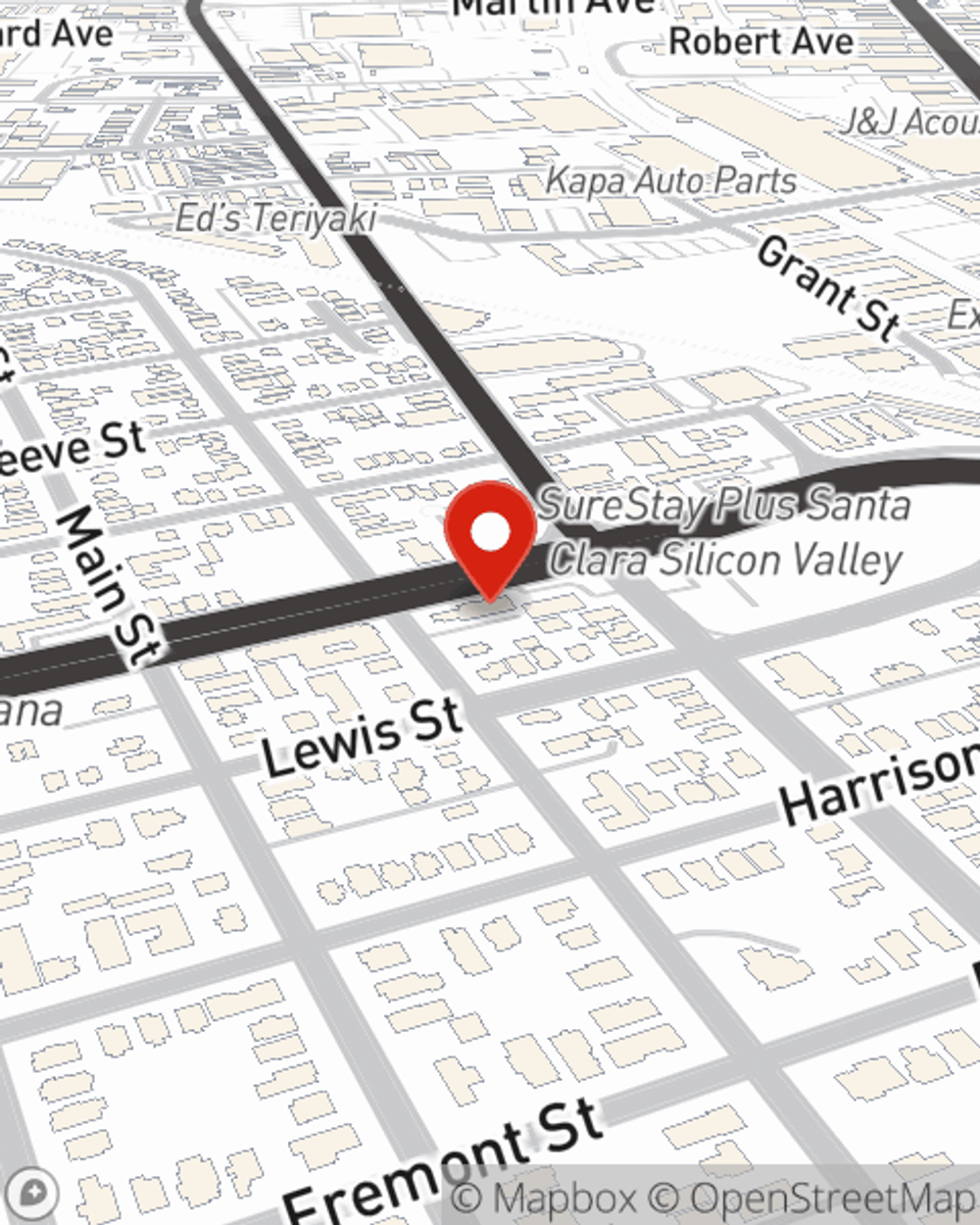

Business Insurance in and around Santa Clara

Get your Santa Clara business covered, right here!

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

Running a business can be risky. It's always better to be prepared for the unfortunate accident, like an employee getting hurt on your business's property.

Get your Santa Clara business covered, right here!

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like extra liability or business continuity plans, that can be designed to develop a customized policy to fit your small business's needs. And when the unexpected does arise, agent Alexandra Anderson can also help you file your claim.

Don’t let concerns about your business stress you out! Contact State Farm agent Alexandra Anderson today, and find out how you can benefit from State Farm small business insurance.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Alexandra Anderson

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.